August 31, 2009

Op-Ed Columnist

Missing Richard Nixon

By PAUL KRUGMAN

Many of the retrospectives on Ted Kennedy’s life mention his regret that he didn’t accept Richard Nixon’s offer of a bipartisan health care deal. The moral some commentators take from that regret is that today’s health care reformers should do what Mr. Kennedy balked at doing back then, and reach out to the other side.

But it’s a bad analogy, because today’s political scene is nothing like that of the early 1970s. In fact, surveying current politics, I find myself missing Richard Nixon.

No, I haven’t lost my mind. Nixon was surely the worst person other than Dick Cheney ever to control the executive branch.

But the Nixon era was a time in which leading figures in both parties were capable of speaking rationally about policy, and in which policy decisions weren’t as warped by corporate cash as they are now. America is a better country in many ways than it was 35 years ago, but our political system’s ability to deal with real problems has been degraded to such an extent that I sometimes wonder whether the country is still governable.

As many people have pointed out, Nixon’s proposal for health care reform looks a lot like Democratic proposals today. In fact, in some ways it was stronger. Right now, Republicans are balking at the idea of requiring that large employers offer health insurance to their workers; Nixon proposed requiring that all employers, not just large companies, offer insurance.

Nixon also embraced tighter regulation of insurers, calling on states to “approve specific plans, oversee rates, ensure adequate disclosure, require an annual audit and take other appropriate measures.” No illusions there about how the magic of the marketplace solves all problems.

So what happened to the days when a Republican president could sound so nonideological, and offer such a reasonable proposal?

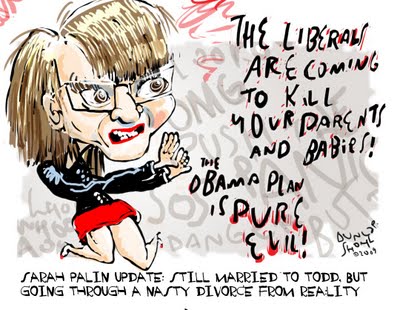

Part of the answer is that the right-wing fringe, which has always been around — as an article by the historian Rick Perlstein puts it, “crazy is a pre-existing condition” — has now, in effect, taken over one of our two major parties. Moderate Republicans, the sort of people with whom one might have been able to negotiate a health care deal, have either been driven out of the party or intimidated into silence. Whom are Democrats supposed to reach out to, when Senator Chuck Grassley of Iowa, who was supposed to be the linchpin of any deal, helped feed the “death panel” lies?

But there’s another reason health care reform is much harder now than it would have been under Nixon: the vast expansion of corporate influence.

We tend to think of the way things are now, with a huge army of lobbyists permanently camped in the corridors of power, with corporations prepared to unleash misleading ads and organize fake grass-roots protests against any legislation that threatens their bottom line, as the way it always was. But our corporate-cash-dominated system is a relatively recent creation, dating mainly from the late 1970s.

And now that this system exists, reform of any kind has become extremely difficult. That’s especially true for health care, where growing spending has made the vested interests far more powerful than they were in Nixon’s day. The health insurance industry, in particular, saw its premiums go from 1.5 percent of G.D.P. in 1970 to 5.5 percent in 2007, so that a once minor player has become a political behemoth, one that is currently spending $1.4 million a day lobbying Congress.

That spending fuels debates that otherwise seem incomprehensible. Why are “centrist” Democrats like Senator Kent Conrad of North Dakota so opposed to letting a public plan, in which Americans can buy their insurance directly from the government, compete with private insurers? Never mind their often incoherent arguments; what it comes down to is the money.

Given the combination of G.O.P. extremism and corporate power, it’s now doubtful whether health reform, even if we get it — which is by no means certain — will be anywhere near as good as Nixon’s proposal, even though Democrats control the White House and have a large Congressional majority.

And what about other challenges? Every desperately needed reform I can think of, from controlling greenhouse gases to restoring fiscal balance, will have to run the same gantlet of lobbying and lies.

I’m not saying that reformers should give up. They do, however, have to realize what they’re up against. There was a lot of talk last year about how Barack Obama would be a “transformational” president — but true transformation, it turns out, requires a lot more than electing one telegenic leader. Actually turning this country around is going to take years of siege warfare against deeply entrenched interests, defending a deeply dysfunctional political system.

Alaskan cartoonist

Alaskan cartoonist

The new credit card landscape

The new credit card landscape